Car Dealers And The Yo-Yo Scam

The yo-yo scam? Yes, it is a trick car dealers use frequently. That’s because there is not much profits for a dealer on the sale of a new car. Where dealers really make their money is in the financing, insurance, service contracts, added charges and options, repairs, and the buying and selling of used vehicles. New car dealers are under significant financial pressure to make profits on these “extras” to make up for the lack of profit from the sale of the new car sale itself. Got that? In addition to selling these “extras,” another way a new car dealer can earn a profit is by selling the note. This practice is not restricted to just new car dealers, either. Used car dealers squeeze money out their deals the same way.

More On The Note

Almost all dealers to “pre-qualify” potential customers then send them home in their new car while they complete the sale of the note to a bank or credit union. And the dealers will deny this, but they become the original creditor through this process. All you have to do is take a look at the retail installment sales contract, and you will find the car dealer listed as the creditor. This is a typical scam that once you get home with your new car, the dealer realizes that they can’t make enough extra profit by selling the note. Or they will determine that you will qualify for a larger note – at a higher interest rate – and you get a phone call. It will be the car dealer demanding that you bring the vehicle back so they can make a better deal.

These Practices Violate The Law

Not only do these scams break the law, but they also bring up several legal issues. Under Texas law and in most other states, to make a transaction contingent on the dealer’s ability to sell the retail installment sales contract, the parties must explicitly agree to such a condition. This means that the sale of that car to you cannot depend on the sale of the note. If that is going to happen, both you and the dealer have to agree to it, instead of agreeing to the sale and purchase of a car.

The Yo-Yo

In worst-case scenarios, the dealer will try a yo-yo sale with no written documents or any other basis for making the sale contingent on financing. Instead, the dealer preys on the consumer’s ignorance (and some court’s confusion) about the dealer’s role in the transaction and the relationship between the dealer and bank or finance company.

The Retail Installment Sales Contract

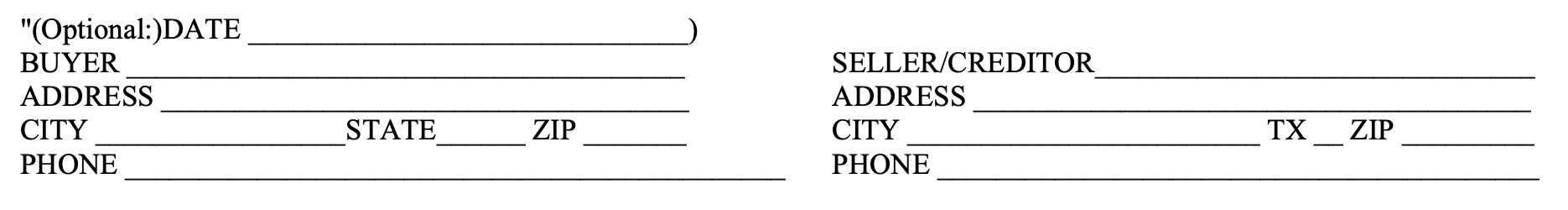

In Texas, at least, the majority of retail installment sales contracts begin with the image at the top of this post. It is the part of the sales contract that identifies the parties. Your name should be entered in the upper left and on the right will be the dealer information. You should see that it says seller/creditor, and that is because the seller is also the creditor. The dealer is the original creditor because the extended you credit so you could qualify to purchase your vehicle. The dealer is the creditor, although they do not intend to accept any payments from you. They are the creditors until and unless the vehicle is sold.

A Closer Look At The Texas Finance Code

Texas Finance Code § 348.013 is the law about conditional delivery agreements here is the beginning of this section:

Sec. 348.013. CONDITIONAL DELIVERY AGREEMENT. (a) In this section, "conditional delivery agreement" means a contract between a retail seller and prospective retail buyer under the terms of which the retail seller allows the prospective retail buyer to use and benefit from a motor vehicle for a specified term.

(b) Subject to this section, a retail seller and prospective retail buyer may enter a conditional delivery agreement.

(c) A conditional delivery agreement is:

(1) an enforceable contract; and

(2) void on the execution of a retail installment contract between the parties of the conditional delivery agreement for the sale of the motor vehicle that is the subject of the conditional delivery agreement.

(d) A conditional delivery agreement may only confer rights consistent with this section and may not confer any legal or equitable rights of ownership, including ownership of the motor vehicle that is the subject of the conditional delivery agreement.

(e) A conditional delivery agreement may not exceed a term of 15 days.

(f) If a prospective retail buyer tenders to a retail seller a trade-in motor vehicle in connection with a conditional delivery agreement:

(1) the parties must agree on the value of the trade-in motor vehicle;

(2) the conditional delivery agreement must contain the agreed value of the trade-in motor vehicle described by Subdivision (1); and

(3) the retail seller must use reasonable care to conserve the trade-in motor vehicle while the vehicle is in the retail seller's possession.

As you can see, under Texas law, selling a vehicle based on the condition that you qualify for credit is a different kind of agreement from buying a car. Conditional delivery is a very different thing compared to selling a vehicle.

The Credit Application Glitch

One of the favorite games played by car dealers is that they will contact you to let you know they are canceling the sale because you lied on the credit application. According to the dealer, this violation triggers a default, or it allows the dealer to cancel based on your material fraudulent misrepresentation. To make the sale, the dealer may insert false information in your credit application without you knowing. They may direct you to make specific misstatements while giving oral assurance that it is alright to do so.

The Finance Agreement Glitch

Another trick that some car dealers use is that they do not sign the financing agreement. Then they will argue with you that the financing agreement is not final for this reason. Regardless, the filled-in contract should be viewed as the dealer’s offer, and your signature would act as acceptance of that offer. In other words, that contract should be binding. The fact that the dealer failed to sign the installment sales agreement may also violate the state installment sales act. Plus, the notations on the contract by the dealer may be sufficient to constitute a signature. Check to see if the dealer’s name is typed below the signature line. That’s because the Texas Business & Commerce Code § 1.201(37) defines “signed” as “any symbol executed or adopted by a party with present intention to adopt or accept a writing.”

More On The Yo-Yo Transaction

The typical yo-yo transaction looks like this: employees at the dealer will repeatedly say things like: “the deal is final” and that “a sale has been made.” These statements will come from the finance and insurance manager, the salesman, the receptionist, and anyone else inside the building who will take the opportunity to congratulate you on your purchase. You’ll even hear statements indicating that your financing has been approved. Brochures will be sent to you, indicating that you have been preapproved or that all credit applications have been approved. Then you buy insurance for that new vehicle before you can leave the car lot.

When you drive off the lot, ownership of that vehicle has to rest with either the dealer or you – ownership cannot be in legal limbo. Dealers will structure yo-yo transactions to fully comply with neither of these scenarios. Instead, they manufacture a legal mishmash that provides them with the majority of benefits. Dealers intermingle and intentionally confuse two very different kinds of transactions – a condition precedent and a condition subsequent sale.

In Conclusion

If it is a conditional delivery agreement, if a sale is truly a condition precedent transaction, then the dealer has no right to sell your trade-in until the sale of the new car has been finalized. After all, the trade-in was provided to the dealer on the condition that the deal goes through. This means that you have not separately sold your existing car to the dealer – the sale happens to be part of the purchase of the new vehicle. To sell the trade-in before the new car purchase has been finalized is considered a conversion.

I hope you have learned something valuable about car dealers and how they can manipulate new car sales. The yo-yo scam is alive and well.

If you are the victim of a yo-yo scam then give us a call 210 226-0800. We provide a no cost case evaluation.